XRP Price Prediction: How High Will XRP Go in 2026?

#XRP

- Technical Indicators: XRP is below its 20-day MA, but MACD suggests bullish momentum.

- Regulatory News: SEC delays and stablecoin recognition create mixed sentiment.

- Institutional Adoption: Global bank investments in blockchain support long-term growth.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

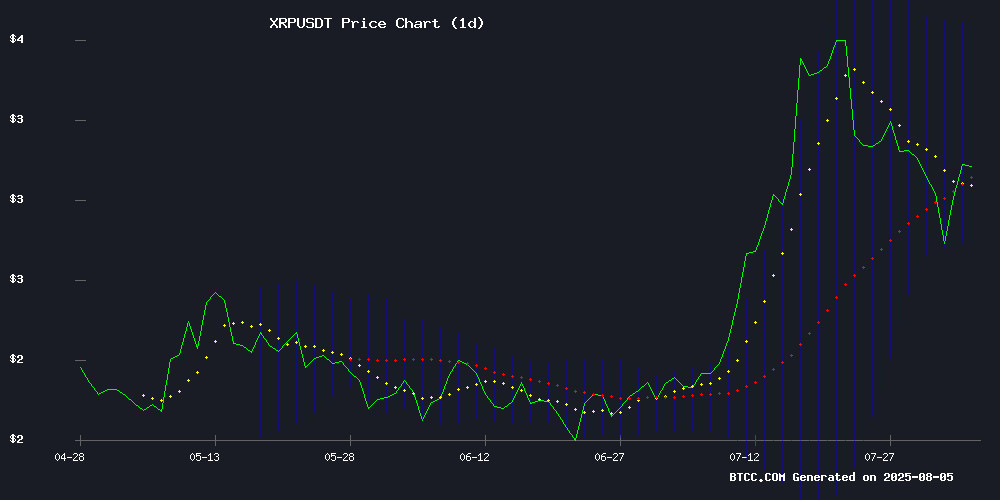

According to BTCC financial analyst Olivia, XRP is currently trading at 3.03500000 USDT, below its 20-day moving average (MA) of 3.1953, indicating potential short-term bearish pressure. The MACD (12,26,9) shows a positive histogram at 0.2657, suggesting some bullish momentum, but the signal line remains negative at -0.0556. Bollinger Bands indicate volatility, with the price NEAR the lower band (2.7719), which could act as support. Olivia notes that a break above the middle band (3.1953) may signal a trend reversal.

XRP Market Sentiment: Regulatory and Institutional Developments

BTCC financial analyst Olivia highlights mixed market sentiment for XRP. Positive developments include the SEC recognizing stablecoins as cash equivalents, which could benefit XRP and RLUSD. However, the delayed SEC appeal vote and potential price correction risks may weigh on short-term performance. Upbit Exchange's influence and ETF speculation have driven a 51% surge in July, but Olivia cautions that bulls may be losing steam. Institutional adoption, such as global banks investing in blockchain projects, supports long-term growth.

Factors Influencing XRP’s Price

XRP Lawsuit Goes Quiet as SEC Delays Internal Vote on Appeal

The XRP lawsuit has entered another quiet phase, nearly five years after the SEC charged Ripple Labs with conducting an unregistered securities offering. Speculation swirls on social media, but legal experts point to a procedural hurdle: the SEC has yet to complete the internal vote required to drop its appeal.

Ripple secured a partial victory in July 2023 when Judge Analisa Torres ruled programmatic XRP sales on exchanges weren’t securities transactions, though institutional sales were. Both sides filed appeals in October 2024, but Ripple withdrew its cross-appeal in June 2025 and placed a $125 million civil penalty in escrow. The SEC’s appeal remains pending, leaving the judgment non-final and the injunction intact.

The agency’s stance on crypto shifted under new leadership after President Trump elevated former commissioner Paul Atkins as chair. Atkins’ August 4 announcement of "Project Crypto" signaled a potential pivot in regulatory approach, but the XRP case remains in limbo.

SEC Recognizes Stablecoins as Cash Equivalents, Boosting XRP and RLUSD Prospects

The U.S. Securities and Exchange Commission has issued interim guidance classifying qualifying USD-pegged stablecoins as cash equivalents on corporate balance sheets. This regulatory shift removes longstanding accounting barriers, paving the way for institutional adoption of digital assets like XRP and Ripple's forthcoming RLUSD stablecoin.

RLUSD appears particularly well-positioned to benefit from the new framework, meeting all SEC criteria for cash equivalence: full fiat backing, 1:1 dollar peg, and guaranteed redemption rights. The stablecoin's reserves consist of US dollar deposits, short-term Treasuries, and other cash equivalents—a structure that aligns perfectly with the SEC's requirements.

Market observers note this development could accelerate institutional involvement in crypto markets, particularly among financial institutions that have been awaiting clearer regulatory guidance. The decision marks a significant step toward mainstream financial integration for compliant digital assets.

The Crucial Ripple (XRP) Metric That No One Is Talking About, and Why it Matters

XRP surged past $3.05 before settling at $3.02, with $4.25 billion in trading volume as whale wallets took profits. Market share rebounded from 4.6% to 5%, signaling potential recovery amid analyst scrutiny.

Traders are closely monitoring mid-August SEC guidance, which could redefine XRP's regulatory standing and market trajectory. The token's dominance, once at 30% of the crypto market, now hovers NEAR 5%—a stark decline that underscores both its challenges and latent upside potential.

Price volatility remains a hallmark, with XRP dipping 4% weekly despite a 1% daily gain. Liquidity persists as it ranks among top-traded large-cap assets, though volume cooled 15% post-surge.

Upbit Exchange May Exert Significant Influence on XRP Price, Analyst Suggests

South Korea's Upbit exchange appears to wield outsized influence over XRP's spot price, according to on-chain analyst Dom. Cumulative-volume-delta data from August 2-4 shows Upbit's selling pressure easing precisely as XRP found a local bottom, despite continued selling on Binance.

The 48-hour chart reveals Upbit's aggressive draw-down of roughly 35 million XRP preceded the token's price reversal. "When Korean selling stopped, we bottomed," Dom noted, observing subsequent upward movement coinciding with Coinbase accumulation of nearly 15 million XRP.

This pattern reinforces Dom's longstanding thesis about Upbit's disproportionate impact on XRP markets. The exchange's order FLOW appears capable of overriding bearish pressure from larger global platforms, creating identifiable inflection points in XRP's price action.

XRP Surges 51% in July Amid ETF Speculation: Long-Term Hold Worth Considering

XRP's 51% July rally has investors questioning whether the cryptocurrency remains a viable long-term hold after partial August pullbacks. The surge reflects growing market anticipation of spot XRP ETF approvals, with the SEC's October 17 deadline looming large. A recent policy shift allowing in-kind redemptions has removed a critical barrier, making regulatory greenlights increasingly probable.

The coin's performance isn't merely speculative momentum. Institutional adoption pathways are materializing, with ETF approvals potentially unlocking billions in regulated capital flows. Market participants appear to be pricing in this structural shift, betting on XRP's transition from speculative asset to mainstream investment vehicle.

While short-term volatility persists, the underlying thesis strengthens. Regulatory clarity and institutional access could redefine XRP's market position, suggesting current prices may still offer entry points for patient investors. The coming months will test whether the July surge marked speculative froth or the beginning of sustained revaluation.

XRP Nears Potential Inflection Point as Analysts Predict Major Surge

XRP's current trading price of $3.05 has sparked intense market debate, with a 2.4% daily gain fueling speculation this may be the last entry point before a significant upward move. Technical models now project ambitious targets ranging from $4.89 to $48.90, supported by improving regulatory clarity and the resolution of the SEC lawsuit.

The cryptocurrency maintains its position as the third-largest digital asset by market capitalization at $180.48 billion. Market participants are evaluating whether current levels constitute a strategic buying opportunity, particularly as bullish momentum builds across the broader crypto sector.

XRP Price at Risk of Correction – Bulls Losing Steam?

XRP price rallied past the $3.00 resistance level, peaking at $3.106 before encountering selling pressure. The digital asset now faces a critical test as it hovers above the 100-hourly Simple Moving Average, with immediate support at $2.920.

A breach below the bullish trend line at $3.065 signals potential near-term weakness. Market participants are watching the $3.10-$3.12 resistance zone closely—a decisive breakout could propel prices toward $3.20, while failure may trigger a deeper retracement toward Fibonacci levels.

Global Banks Invest in 345 Blockchain Projects as Digital Assets Go Mainstream

Traditional finance is undergoing a seismic shift as global banks completed 345 blockchain investments between 2020 and 2024. Leading institutions like JP Morgan, Goldman Sachs, and Japan's SBI Group are focusing on seed and Series A funding rounds, signaling long-term confidence in digital asset infrastructure rather than speculative bets.

Brazilian payment processor CloudWalk secured the largest single investment—$750 million from Banco Itaú, BTG Pactual, and Banco Safra. Meanwhile, Germany's Solaris raised over $100 million with SBI Group participation. HSBC made waves with its quantum-secure Gold Token launch in Hong Kong, pioneering post-quantum cryptography protections for institutional tokenization.

Global Banks Accelerate Blockchain Adoption with Strategic Investments

Traditional financial institutions are no longer dabbling in blockchain technology—they're building it into their Core strategies. Between 2020 and 2024, global banks participated in 345 blockchain-related investments, according to a new Ripple report. The movement signals a decisive shift from experimental pilots to infrastructure development.

JP Morgan, Goldman Sachs, and SBI Group have emerged as aggressive early-stage backers, primarily targeting seed and Series A rounds. Their bets align with long-term digital finance roadmaps rather than short-term experimentation. In Brazil, CloudWalk's $750 million funding round—backed by Banco Itaú, BTG Pactual, and Banco Safra—represents one of the largest traditional bank investments in blockchain infrastructure to date.

Germany's Solaris illustrates the strategic depth of these moves. After raising $100 million with SBI Group's participation in 2024, the company launched Germany's first regulated digital asset trading venue. SBI subsequently acquired a majority stake, using the platform as a bridgehead for European expansion.

Could a $500 XRP Investment Today Become $25,000 by 2026? Experts Weigh In

XRP is attracting renewed attention as traders evaluate its potential for significant gains by 2025 and beyond. Analysts project a possible rise to $4.70 by 2026, turning a $500 investment at today's $2.78 price into a modest 68% return—far from the explosive growth seen in crypto's early days.

The token's long-term prospects remain strong, buoyed by speculation around spot ETF approvals and its utility in cross-border payments. Yet, the focus is shifting toward smaller-cap projects like MAGACOIN FINANCE, which offer higher upside potential during their early breakout phases.

Early-stage tokens are back in vogue as investors seek asymmetric opportunities. XRP's maturation limits its capacity for exponential returns, prompting retail traders and crypto whales to explore leaner, community-driven alternatives with viral momentum.

Ripple Considers Modular Refactor of XRP Ledger, Rust Emerges as Frontrunner

Ripple CTO David Schwartz has revealed internal discussions about a potential overhaul of the XRP Ledger's architecture, with Rust being considered as the primary language for a modular rebuild. The move WOULD address technical debt in the current C++ codebase while maintaining user-facing continuity.

The proposed refactor aims to decouple the ledger's transaction engine from its consensus mechanism, enabling execution in a VIRTUAL machine environment. Schwartz emphasized that any changes would preserve the existing state of on-chain data and user experience.

This potential transformation marks the most significant architectural evolution since XRPL's inception, reflecting growing demands for scalability and flexibility in blockchain infrastructure. The deliberations come as institutional adoption of XRP continues to accelerate across global payment systems.

How High Will XRP Price Go?

BTCC financial analyst Olivia provides a balanced outlook for XRP. Technical indicators suggest short-term consolidation, but long-term potential remains strong due to institutional adoption and regulatory clarity. Below is a summary of key data:

| Metric | Value |

|---|---|

| Current Price | 3.03500000 USDT |

| 20-Day MA | 3.1953 |

| MACD Histogram | 0.2657 |

| Bollinger Bands (Lower/Middle/Upper) | 2.7719 / 3.1953 / 3.6186 |

Olivia notes that while a $500 investment today could yield significant returns by 2026, investors should monitor SEC developments and market sentiment closely.

| Metric | Value |

|---|---|

| Current Price | 3.03500000 USDT |

| 20-Day MA | 3.1953 |

| MACD Histogram | 0.2657 |

| Bollinger Bands (Lower/Middle/Upper) | 2.7719 / 3.1953 / 3.6186 |